MIRAE ASSET MULTI

ASSET ALLOCATION FUND $

(Multi Asset Allocation Fund - An open-ended scheme investing in equity, debt & money market

instruments, Gold ETFs, Silver ETFs and exchange traded commodity derivatives)

| Type of Scheme | Multi Asset Allocation Fund - An open-ended scheme investing in equity, debt & money market instruments, Gold ETFs, Silver ETFs and exchange traded commodity derivatives |

| Investment Objective | The investment objective of the scheme is to provide long-term capital appreciation from a portfolio investing in equity and equity related securities, Debt and money market instruments, Gold ETFs, Silver ETFs and Exchange Traded Commodity Derivatives. However, there is no assurance that the investment objective of the Scheme will be realized. |

Fund Manager** |

Mr. Harshad Borawake (Equity portion) (since January 31, 2024), Mr. Amit Modani (Debt portion) (since January 31, 2024) Mr. Siddharth Srivastava (Dedicated Fund Manager for Overseas Investments) (since since January 31, 2024) Mr. Ritesh Patel (Dedicated Fund Manager for Commodity Investments) (since January 31, 2024) |

| Allotment Date | 31st January, 2024 |

| Benchmark Index | 65% BSE 200 TRI + 20% NIFTY Short Duration Debt Index + 10% Domestic Price of Gold + 5% Domestic Price of Silver@ |

| Minimum Investment Amount |

₹ 5,000/- and in multiples of ₹ 1/- thereafter Minimum Additional Application Amount: ₹ 1,000/- per application and in multiples of ₹ 1/- thereafter. |

Systematic Investment Plan (SIP) (Any Date SIP is available from 1st July, 2019) |

Monthly and Quarterly: ₹ 500/- (multiples of ₹ 1/- thereafter), minimum 5 in case of Monthly / Quarterly option. |

| Load Structure | Entry load: NA Exit Load: If redeemed within 1 year (365 days) from the date of allotment: 1% If redeemed after 1 year (365 days) from the date of allotment: NIL |

| Plans Available | Regular Plan and Direct Plan |

| Options Available | Growth Option and IDCW Option (Payout & Re-investment) |

| Monthly Average AUM (₹ Cr.) as on June 30, 2024 | 1,492.47 |

| Net AUM (₹ Cr.) |

1,524.79 |

| Monthly Total Expense Ratio (Including Statutory Levies) as on June 30, 2024 |

Regular Plan: 2.04% Direct Plan: 0.40% |

| **For experience of Fund Managers Click Here | |

| NAV: | Direct | Regular |

| Growth | ₹ 11.013 | ₹ 10.938 |

| IDCW | ₹ 11.013 | ₹ 10.936 |

Average Maturity |

4.20 Years |

Modified Duration |

3.11 Years |

Macaulay Duration |

3.25 Years |

Annualized Portfolio YTM* |

7.40% |

*In case of semi annual YTM, it will be annualized.

| Portfolio Holdings | % Allocation |

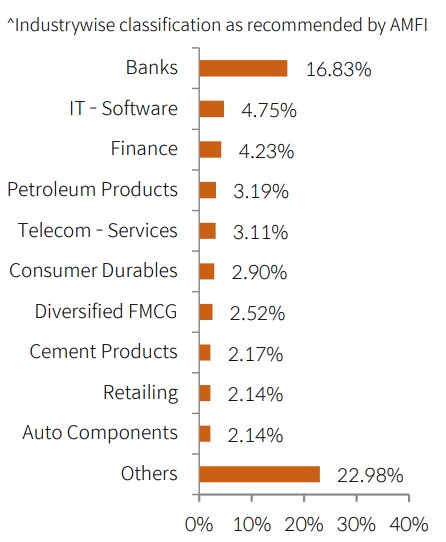

Banks |

|

HDFC Bank Ltd |

5.72% |

ICICI Bank Ltd |

2.77% |

State Bank of India |

2.63% |

Axis Bank Ltd |

1.91% |

Kotak Mahindra Bank Ltd |

1.55% |

IndusInd Bank Ltd |

0.79% |

The Federal Bank Limited |

0.75% |

Bank of Baroda |

0.40% |

RBL Bank Limited |

0.31% |

IT - Software |

|

Infosys Ltd |

1.95% |

Tata Consultancy Services Ltd |

1.41% |

LTIMindtree Limited |

0.63% |

Wipro Ltd |

0.49% |

Zensar Technologies Limited |

0.24% |

HCL Technologies Limited |

0.01% |

Finance |

|

Shriram Finance Limited |

1.57% |

IIFL Finance Limited |

0.50% |

India Shelter Finance Corporation Limited |

0.47% |

LIC Housing Finance Limited |

0.42% |

Fusion Micro Finance Limited |

0.41% |

Bajaj Finserv Limited |

0.40% |

Power Finance Corporation Ltd |

0.37% |

L&T Finance Limited |

0.10% |

Petroleum Products |

|

Reliance Industries Ltd |

2.50% |

Bharat Petroleum Corporation Limited |

0.37% |

Hindustan Petroleum Corporation Ltd |

0.32% |

Telecom - Services |

|

Bharti Airtel Ltd |

2.04% |

Indus Towers Limited |

0.61% |

Tata Communications Limited |

0.46% |

Consumer Durables |

|

Titan Company Ltd |

0.67% |

Dixon Technologies (India) Limited |

0.52% |

Voltas Ltd |

0.51% |

Havells India Ltd |

0.41% |

Cera Sanitaryware Limited |

0.40% |

Century Plyboards (India) Limited |

0.35% |

Kajaria Ceramics Ltd |

0.04% |

Diversified FMCG |

|

ITC Ltd |

1.51% |

Hindustan Unilever Ltd |

1.00% |

Cement & Cement Products |

|

Ambuja Cements Limited |

0.99% |

ACC Limited |

0.69% |

Dalmia Bharat Limited |

0.40% |

UltraTech Cement Limited |

0.09% |

Retailing |

|

Zomato Limited |

0.63% |

Go Fashion (India) Limited |

0.48% |

Electronics Mart India Limited |

0.47% |

Trent Limited |

0.32% |

Avenue Supermarts Limited |

0.25% |

Auto Components |

|

Samvardhana Motherson International Limited |

1.10% |

Craftsman Automation Limited |

0.67% |

Balkrishna Industries Ltd |

0.36% |

Pharmaceuticals & Biotechnology |

|

Gland Pharma Limited |

0.57% |

Cipla Limited |

0.50% |

Torrent Pharmaceuticals Ltd |

0.35% |

Aurobindo Pharma Ltd |

0.22% |

Glenmark Pharmaceuticals Limited |

0.22% |

Divi's Laboratories Ltd |

0.20% |

Sun Pharmaceutical Industries Ltd |

0.08% |

Construction |

|

Larsen & Toubro Ltd |

2.10% |

Power |

|

NTPC Ltd |

1.33% |

Power Grid Corporation of India Ltd |

0.54% |

Tata Power Company Limited |

0.10% |

Personal Products |

|

Godrej Consumer Products Limited |

0.94% |

Dabur India Ltd |

0.88% |

Automobiles |

|

Tata Motors Limited |

1.17% |

Eicher Motors Ltd |

0.64% |

Maruti Suzuki India Ltd |

0.00% |

Insurance |

|

SBI Life Insurance Company Limited |

0.65% |

HDFC Life Insurance Company Ltd |

0.39% |

Go Digit General Insurance Limited |

0.29% |

ICICI Lombard General Insurance Company Limited |

0.08% |

Non - Ferrous Metals |

|

Hindalco Industries Limited |

1.33% |

Realty |

|

Brigade Enterprises Limited |

1.03% |

DLF Limited |

0.29% |

Aerospace & Defense |

|

Bharat Electronics Ltd |

0.77% |

Hindustan Aeronautics Limited |

0.56% |

Transport Services |

|

InterGlobe Aviation Limited |

0.74% |

Container Corporation of India Limited |

0.32% |

Leisure Services |

|

TBO Tek Limited |

0.68% |

Indian Railway Catering And Tourism Corporation Limited |

0.33% |

Consumable Fuels |

|

Coal India Ltd |

0.94% |

Gas |

|

GAIL (India) Limited |

0.81% |

Industrial Products |

|

RHI Magnesita India Limited |

0.36% |

R R Kabel Limited |

0.35% |

Healthcare Services |

|

Apollo Hospitals Enterprise Limited |

0.46% |

Syngene International Limited |

0.19% |

Diversified Metals |

|

Vedanta Limited |

0.46% |

Ferrous Metals |

|

Tata Steel Ltd |

0.46% |

Oil |

|

Oil & Natural Gas Corporation Limited |

0.40% |

Electrical Equipment |

|

TD Power Systems Limited |

0.38% |

Capital Markets |

|

Multi Commodity Exchange of India Limited |

0.37% |

Chemicals & Petrochemicals |

|

Atul Limited |

0.21% |

SRF Limited |

0.13% |

Agricultural Food & other Products |

|

Balrampur Chini Mills Limited |

0.17% |

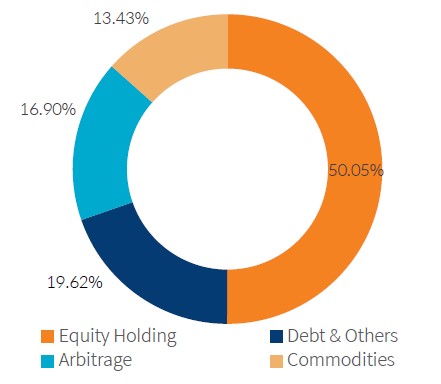

Equity Holdings Total |

66.95% |

Exchange Traded Funds |

|

Mirae Asset Mutual Fund |

13.43% |

Exchange Traded Funds Total |

13.43% |

Corporate Bond |

|

Indian Railway Finance Corporation Limited |

1.64% |

National Bank For Agriculture and Rural Development |

1.64% |

REC Limited |

1.64% |

Small Industries Dev Bank of India |

1.64% |

NTPC Limited |

0.16% |

Corporate Bond Total |

6.73% |

Government Bond |

|

7.18% GOI (MD 14/08/2033) |

3.70% |

7.1% GOI (MD 08/04/2034) |

0.78% |

7.18% GOI (MD 24/07/2037) |

0.66% |

Government Bond Total |

5.14% |

Certificate of Deposit |

|

HDFC Bank Limited |

0.94% |

Kotak Mahindra Bank Limited |

0.81% |

Axis Bank Limited |

0.75% |

Canara Bank |

0.19% |

Certificate of Deposit Total |

2.68% |

Commercial Paper |

|

Infina Finance Private Limited CP (MD 10/12/2024) |

1.01% |

Commercial Paper Total |

1.01% |

REIT |

|

Embassy Office Parks REIT |

0.47% |

REIT Total |

0.47% |

Cash & Other Receivables Total |

3.59% |

Total |

100.00% |

| Name of the Instrument | % to Net Assets |

| Derivatives | |

| Index / Stock Futures | |

| HCL Technologies Limited | -0.01% |

| Wipro Limited | -0.03% |

| ICICI Lombard General Insurance Company Limited | -0.08% |

| L&T Finance Limited | -0.10% |

| Tata Power Company Limited | -0.10% |

| Axis Bank Limited | -0.15% |

| Balrampur Chini Mills Limited | -0.17% |

| Shriram Finance Limited | -0.25% |

| NTPC Limited | -0.26% |

| Vedanta Limited | -0.27% |

| The Federal Bank Limited | -0.27% |

| DLF Limited | -0.30% |

| RBL Bank Limited | -0.31% |

| Trent Limited | -0.32% |

| Hindustan Petroleum Corporation Limited | -0.32% |

| Indian Railway Catering And Tourism Corporation Limited | -0.34% |

| Coal India Limited | -0.34% |

| Hindustan Unilever Limited | -0.36% |

| Dabur India Limited | -0.36% |

| Infosys Limited | -0.37% |

| Reliance Industries Limited | -0.37% |

| Multi Commodity Exchange of India Limited | -0.37% |

| ITC Limited | -0.38% |

| IndusInd Bank Limited | -0.39% |

| Tata Consultancy Services Limited | -0.39% |

| HDFC Life Insurance Company Limited | -0.40% |

| Bajaj Finserv Limited | -0.40% |

| Bank of Baroda | -0.40% |

| Tata Motors Limited | -0.41% |

| LIC Housing Finance Limited | -0.42% |

| Larsen & Toubro Limited | -0.42% |

| Titan Company Limited | -0.44% |

| Tata Communications Limited | -0.46% |

| Ambuja Cements Limited | -0.46% |

| Bharti Airtel Limited | -0.51% |

| State Bank of India | -0.51% |

| Voltas Limited | -0.51% |

| Dixon Technologies (India) Limited | -0.52% |

| InterGlobe Aviation Limited | -0.54% |

| Hindalco Industries Limited | -0.54% |

| Hindustan Aeronautics Limited | -0.56% |

| GAIL (India) Limited | -0.59% |

| Kotak Mahindra Bank Limited | -0.64% |

| ACC Limited | -0.70% |

| HDFC Bank Limited | -0.86% |

| Total | -16.90% |

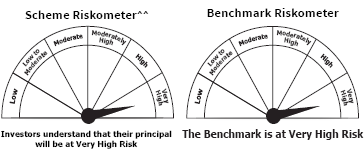

This product is suitable for investors who are seeking*

• To generate long term capital appreciation/income

• Investments in equity, debt & money market instruments, Gold ETFs, Silver ETFs and Exchange Traded commodity derivatives

*Investors should consult their financial advisers if they are not clear about the suitability of the product.

^^As per notice cum addendum no. 30/2024 riskometer of the scheme has changed. Please visit the website for more details https://www.miraeassetmf.co.in/downloads/statutory-disclosure/addendum

$Pursuant to clause 13.2.2 of SEBI master circular dated June 27, 2024, the scheme is in existence for less than 6 months, hence performance shall not be provided.

Please visit the website for more details

https://www.miraeassetmf.co.in/downloads/statutory-disclosure/addendum